stash tax documents turbotax

-Line 11 on Form 1040 and 1040-SR for tax year 2020 -Line 8b on Form 1040. A 1099-DIV tax form is for getting paid on dividends.

Stash Invest Review 2022 A More Flexible Micro Investing App

Once youve logged in you can also click on your name in the top right corner of the screen select Statements Tax.

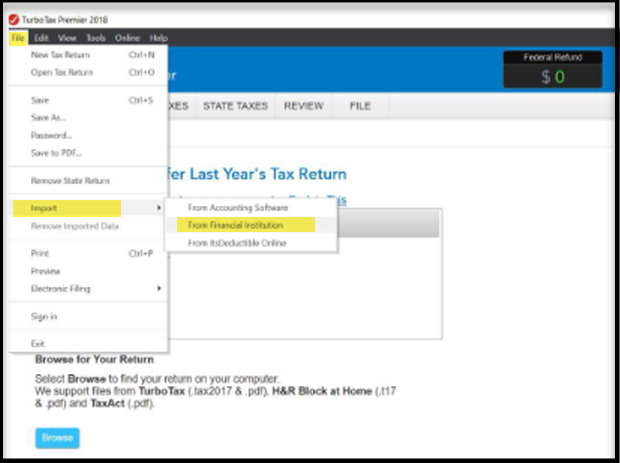

. Stash is not a bank or depository institution licensed in any jurisdiction. You will need your Stash account number for each account that you have. Heres how you can find your Stash account number during TurboTaxs Direct Document Import.

Select Statements Tax Documents from the menu on the left. When you enter the info from the 1099B in the appropriate sections of TurboTax it will generate the form witht he. Navigate to the account type you are.

Navigate to the account type you are looking for documentation on. Click Tax Documents - now youve got the documentation. Click Tax Documents for each Stash account.

Only enter account numbers for. You enter the info from that form in 8949. The above link should take you to your documents.

Stash is not a bank or depository institution licensed in any jurisdiction. Form 1099-B is included in TurboTax Premier TurboTax Live Premier Self-Employed and TurboTax Live Self-Employed online and in all personal CDDownload versions. Is a digital financial services company offering financial products for US.

You are holding form 1099B. Your AGI Adjusted Gross Income can be found on. No matter the investment platform if you recognize gains receive dividends or earn investment income from investments youll still need to pay your share of taxes.

Even if you bought shares at various dates or at different prices. As the leader in tax preparation more federal. The 1099-DIV is a common.

Great news if you are using TurboTax to file your taxes this year TurboTax will allow you to share your Stash account information and directly import your tax. As one of our. Advisory products and services are offered through Stash Investments LLC an SEC registered investment adviser.

Stash tax documents turbotax. If you earned more than 10 in dividends from your Stash investments youll receive a 1099-DIV. 15 deadline to use the TurboTax Live Full Service Basic to file a simple return for free.

Before you file your return get it reviewed by a tax specialist to ensure that your specific tax situation is handled correctly. The YNAB budgeting app and its simple four-rule. Category Cryptocurrency Tax Calculator.

Filers have a Feb.

Turbotax Direct Import Instructions Official Stash Support

How Can I Change My Email Address On Turbotax

Can I Import My Sofi Invest Tax Documents Into Turbotax Sofi

Common And Complex Taxcroynms Decoded The Turbotax Blog

When Is Tax Day Here S How You Can File Your Taxes Online

Online Tax Resource Center Stash

Cut Your Taxes 33 Ways To Pay Less In 2016 And 2017 Money

Turbotax Review A Leader In Diy Taxes

Turbotax Direct Import Instructions Official Stash Support

Turbotax Review A Leader In Diy Taxes

Online Tax Resource Center Stash

Stash Tax Day Is Almost Here You Know What That Facebook

Here S The First Place To Stash Your Retirement Savings In 2022 Personal Finance Stltoday Com

Irs Tax Forms What Do I Need To File My Tax Return In 2022 Money

Hackers Begin Spoofing Fintech Apps As Tax Season Approaches